India AI Summit 2026: Key Announcements and What They Mean for You

March 6, 2026

The India AI Summit 2026 has attracted attention from technology leaders, startups, policymakers, and researchers because artificial intelligence is becoming a major driver of economic growth and innovation. As countries around the world invest heavily in AI technologies, India is ... Read more

“Pavazha Malli” Trending: Meaning, Artist, and Why Everyone’s Searching

March 6, 2026

“Pavazha Malli” has recently become a trending search among music listeners across streaming platforms and social media. Songs often trend when they appear in films, go viral on short-video platforms, or gain popularity through live performances and fan sharing. Regional ... Read more

Smartwatch in Exams: What Counts as Cheating + Rules Students Miss

March 6, 2026

Smartwatches and other wearable devices have become common in everyday life, but their presence in examination halls has raised concerns among education authorities. Because smartwatches can access internet features, messaging apps, and stored information, many exam boards treat them the ... Read more

Tsitsipas vs Shapovalov: Preview, H2H, and Key Matchups

March 5, 2026

Whenever Stefanos Tsitsipas faces Denis Shapovalov, tennis fans expect an aggressive, high-tempo match. Both players belong to the generation that emerged after the dominance of the “Big Three,” and their playing styles often produce entertaining rallies and momentum swings. Tsitsipas ... Read more

Indian Wells 2026: India Timings, Order of Play, and Where to Watch

March 5, 2026

The Indian Wells Masters, officially known as the BNP Paribas Open, is one of the biggest tennis tournaments outside the Grand Slams. Held annually in Indian Wells, California, the event attracts the world’s top players from both the ATP and ... Read more

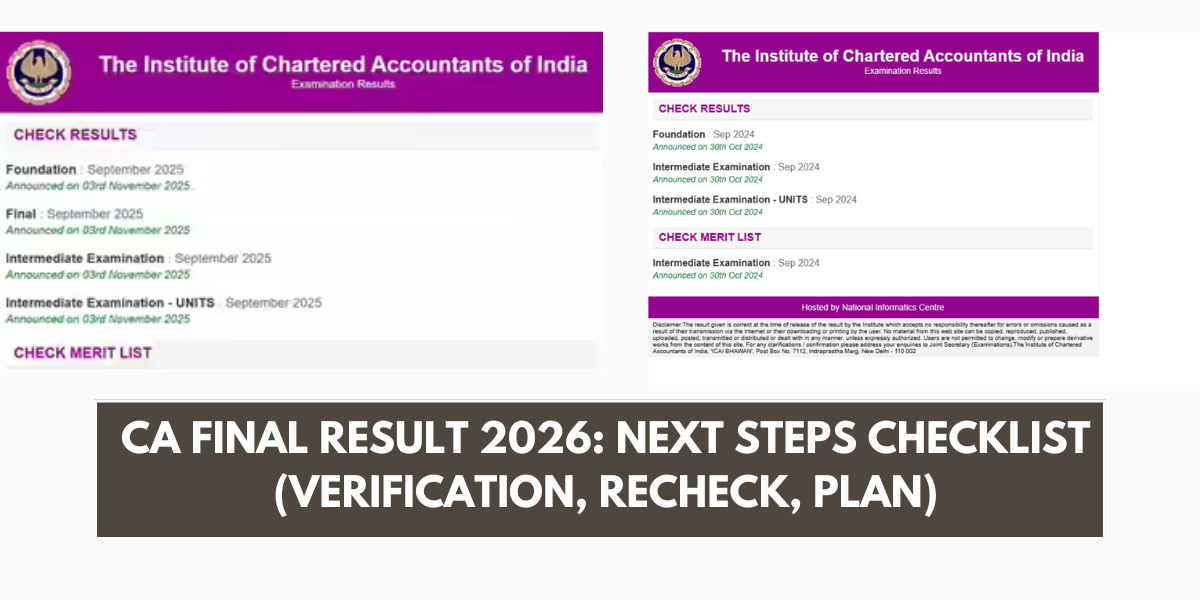

NEET UG 2026: 12 Registration Mistakes That Get Forms Rejected

March 5, 2026

The NEET UG (National Eligibility cum Entrance Test) is one of the most competitive medical entrance exams in India. Every year, millions of students apply for the exam, which is conducted by the National Testing Agency (NTA). Because of the ... Read more

NEET UG 2026 Registration: Documents, Last Date Cues, and Mistakes to Avoid

March 4, 2026

Searches for NEET UG 2026 registration increase every year as students preparing for medical entrance exams begin checking eligibility requirements, application steps, and important deadlines. The National Eligibility cum Entrance Test (NEET-UG) is the primary entrance examination for undergraduate medical ... Read more

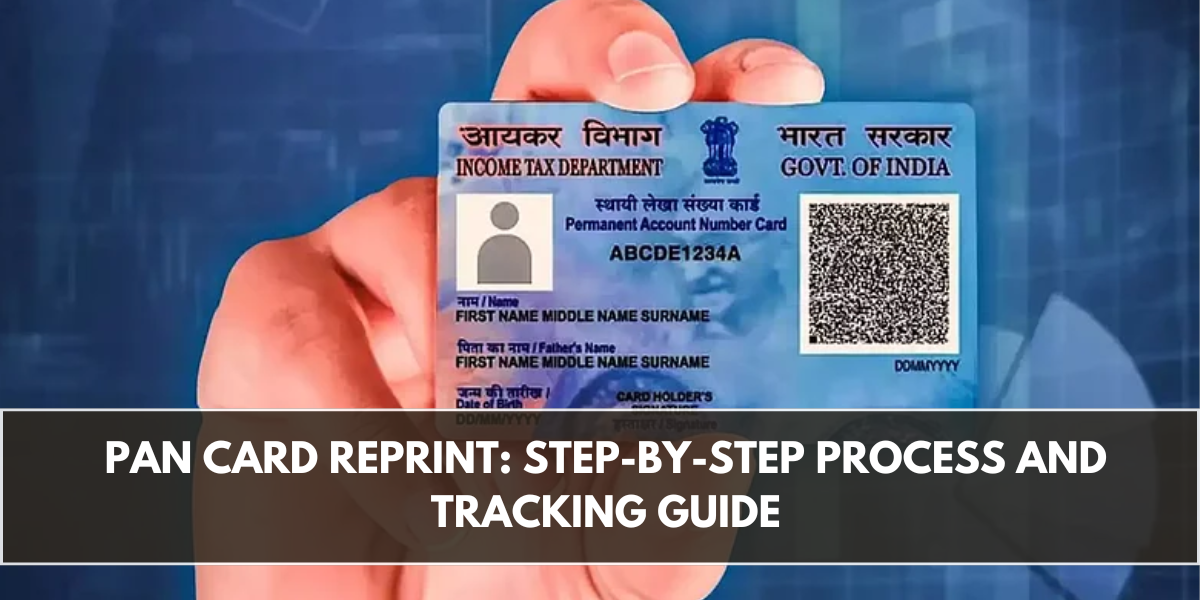

PAN Card Reprint: Step-by-Step Process and Tracking Guide

March 4, 2026

Searches related to PAN card reprint often increase when individuals lose their physical PAN card or when the card becomes damaged. The Permanent Account Number (PAN) is a crucial financial identification document in India and is required for income tax ... Read more